Picture this: you've been driving for clients, running errands, volunteering, or going to the doctor for months. You've kept track of the miles in your head, telling yourself, "It's not that much." But when tax time comes around, that loose mental count could cost you thousands of dollars. The IRS has changed its Standard Mileage Rates for 2025, so now is the time to make sure every mile counts.

This guide takes IRS rules, expert financial advice, and useful tips and turns them into a step-by-step plan for getting the most out of your mileage deductions this year. No fluff, no guesswork—just the information you need to get what you deserve.

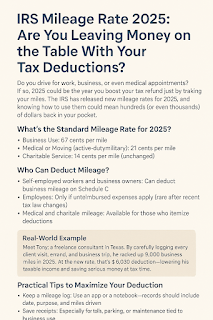

What You Need to Know About the 2025 Standard Mileage Rates

Every year, the IRS looks at the costs of owning a car, such as gas, repairs, insurance, and depreciation, and changes the Standard Mileage Rate to reflect those costs. The official rates for 2025 are:

-

70 cents per mile for business use

-

21 cents per mile for medical or moving purposes for active-duty military

-

14 cents per mile for charitable service

The 70 cents per mile business rate is the highest it's been in a long time. This is because vehicle prices are going up and the economy is putting pressure on costs. IRS News Release IR-2024-312 says that this change is a direct response to market trends.

Who Can Really Get This Deduction?

People who own their own business or work for themselves are the main beneficiaries. Freelancers, sole proprietors, partners, or LLC members who use their own car for business can deduct the cost of travel for business.

Qualifying trips include:

-

Client visits

-

Business errands

-

Travel between main and secondary business locations

-

Short-term assignments outside of your main office

Important: you can never deduct commuting to work every day.

After the Tax Cuts and Jobs Act of 2017, most W-2 employees can't deduct mileage. Only a small number remain eligible, including:

-

Certain performing artists

-

State or local government officials

-

Armed Forces reservists

Taxpayers who itemize can also deduct travel for medical or charitable reasons.

-

Medical trips: visits to a doctor, hospital, or pharmacy, deductible only if total medical costs exceed 7.5% of adjusted gross income

-

Charitable trips: 14 cents per mile for volunteering with a qualified 501(c)(3) organization

-

Military moving trips: 21 cents per mile for active-duty members relocating due to orders

How to Make Sure Your Deductions Are Audit-Proof: Your Mileage Log

Professional tax advisors emphasize: document everything as it happens. IRS Publication 463 outlines a good log that includes:

-

Date of each trip

-

Starting and ending addresses

-

Reason for the trip

-

Total miles driven

-

Starting and ending odometer readings

Using apps or a dedicated notebook ensures accuracy and credibility. The IRS recommends keeping records for at least three years, but most experts suggest seven years for added security.

How to Pick the Right Deduction Method: Actual Expenses vs. Standard Mileage

If you drive your car for work, you face an important choice:

-

Standard Mileage Rate: simple, less record-keeping, often better for high-mileage or fuel-efficient drivers, but excludes some depreciation and variable costs

-

Actual Expenses Method: lets you deduct the business-use percentage of all vehicle costs—gas, repairs, insurance, registration, lease payments, depreciation—but requires careful record-keeping

Example:

A freelance designer drives 15,000 miles for work.

-

Standard Mileage Rate: 15,000 × $0.70 = $10,500

-

Actual Expenses Method: $8,000 × 75% = $6,000

In this case, the Standard Mileage Rate gives a $4,500 advantage. Best practice: calculate both methods annually to maximize your deduction.

Why the 2025 Rate Is More Important Than Ever

The rise to 70 cents per mile reflects real costs:

-

Fuel prices fluctuate due to global market instability

-

Maintenance costs increase due to labor shortages and supply chain issues

-

Depreciation represents long-term vehicle ownership costs

Mid-year IRS adjustments are rare, so the 2025 rate is a predictable benchmark for planning your finances.

FAQ: Important Information About Mileage Deductions

-

You can start with Standard Mileage Rate and switch to Actual Expenses later. Once you start using Actual Expenses, you must continue that method for the vehicle’s life.

-

Parking fees and tolls are deductible under both methods.

-

Gig economy drivers can deduct every mile while "on the job," including pickups, drop-offs, and being available for work. Commuting is still non-deductible.

-

The rate applies to all vehicle types: gas, diesel, hybrid, and fully electric.

-

Keep records for at least three years, though seven years is recommended.

Last thought: Don’t leave money on the table. Every mile counts. With the 2025 IRS changes, keeping good records and choosing the right method could save you thousands of dollars. Act now whether you’re self-employed, volunteering, or traveling for medical reasons. Your tax return will thank you.

Disclaimer

This article is only for informational and educational purposes. It is not legal, tax, or financial advice. The information comes from IRS data that is available to the public and generally accepted accounting principles. However, tax laws are complicated and can change.

You should talk to a qualified tax professional (CPA) or lawyer before filing your taxes or applying for a deduction, because everyone's situation is different. You are fully responsible for any actions you take based on the information in this article.

Comments

Post a Comment